Page Description

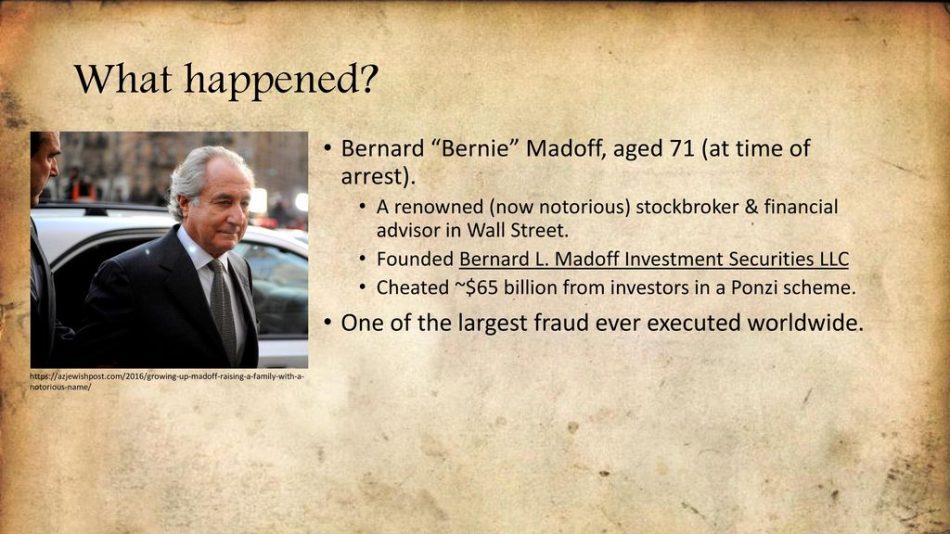

Explore the life and scandal of Bernie Madoff, focusing on his infamous Ponzi scheme and its impact on investors and the financial world.

A renowned (now notorious) stockbroker & financial advisor in Wall Street. Founded Bernard L. Madoff Investment Securities LLC. Cheated ~ 65 billion from investors in a Ponzi scheme. One of the largest fraud ever executed worldwide. https://azjewishpost.com/2016/growing-up-madoff-raising-a-family-with-a-notorious-name/

Bernie Madoff: The Ponzi Scheme That Shocked the World

Bernie Madoff’s Ponzi scheme, one of the largest financial frauds in history, left a trail of devastation, costing investors billions and forever changing the landscape of financial regulation. Once a well-respected financier, Madoff’s downfall exposed the dark side of unchecked greed and deception.

This page delves into the details of Madoff’s fraudulent operation, exploring how he was able to deceive investors, regulators, and even his own family for decades. Through a series of videos and in-depth explanations, we unravel the complexity of the scheme, the individuals involved, and the global impact of Madoff’s actions.

The content also covers the legal proceedings that followed his arrest, the victims who lost everything, and the broader lessons learned from the scandal. Explore the full story of Bernie Madoff and the legacy of his crime that continues to influence the financial world today.

Bernie Madoff: Het Ponzi-Schema dat de Wereld Schokte

Het Ponzi-schema van Bernie Madoff, een van de grootste financiële fraudes in de geschiedenis, liet een spoor van verwoesting achter, kostte investeerders miljarden en veranderde voorgoed het landschap van financiële regelgeving. Ooit een gerespecteerd financier, bracht Madoffs ondergang de duistere kant van onbeheersbare hebzucht en bedrog aan het licht.

Deze pagina duikt diep in de details van Madoffs frauduleuze operatie en onderzoekt hoe hij decennialang investeerders, toezichthouders en zelfs zijn eigen familie wist te misleiden. Aan de hand van een reeks video’s en diepgaande analyses ontrafelen we de complexiteit van het schema, de betrokken personen en de wereldwijde impact van Madoffs daden.

De inhoud behandelt ook de juridische procedures na zijn arrestatie, de slachtoffers die alles verloren en de bredere lessen die uit het schandaal zijn getrokken. Ontdek het volledige verhaal van Bernie Madoff en de nalatenschap van zijn misdaad, die de financiële wereld tot op de dag van vandaag blijft beïnvloeden.

Inside the Madoff Scandal | Andrew Cohen

Back to menu IMPORTANT CONTENT

26 jan 2023 Excess Returns

With the recent release of the Netflix documentary “Madoff: The Monster of Wall Street,” many of us have been learning more of the details behind the scandal.

This week, are are joined by Andrew Cohen, who participated in the documentary and was both a trader on the legitimate side of Madoff’s business and a victim of the Ponzi scheme. Andrew gives us a inside look at what it was like to work in the Madoff organization and takes us through the timeline of events from when he started there to when the Ponzi scheme was uncovered. We also talk about his biggest personal lessons from the experience and what he thinks other investors can learn from it.

Inside the LARGEST Ponzi Scheme in History: The Bernie Madoff Scandal

Back to menu IMPORTANT CONTENT

Steve Jobs: Discovering The Truth About The Apple Founder’s Death | Our History

Back to menu IMPORTANT CONTENT

12 jan 2023 Factual America Podcast

No one knows when Bernie Madoff created the Ponzi scheme that would one day lose $64 billion and ruin many lives. Subscribe for more from Factual America: http://bit.ly/AlamoPictures

Madoff said it started late on. In this episode of Factual America, Joe Berlinger, director and executive producer of Madoff: The Monster of Wall Street, tells host, Matthew Sherwood, that he thinks it was right at the start of Madoff’s career, after he lost $30,000 of investors’ money and, upon receiving a loan to pay it back, chose to lie about what had happened rather than admit the truth.

Whatever the answer, Madoff did not act alone. Others helped him, both actively and – in the case of regulators and banks – through their negligence. Year after year, Madoff’s investments remained profitable despite this being financially impossible. He got away with it though, because, as Joe tells Matthew, ‘people just look the other way when greed is involved.’

In the end, it took a ‘Black Swan’ event – the 2008 financial crisis – to bring Madoff’s sham success to a cataclysmic end.

With his own longstanding interest in stock markets and thirty years experience as a documentary filmmaker, Joe Berlinger is the ideal man to tell the story of Bernie Madoff’s rise and fall. As well as discussing Madoff’s Ponzi scheme, Joe and Matthew look at how what happened with Madoff finds an echo today with the unfolding FTX scandal. They also discuss whether or not Joe worries about standing out from other filmmakers, and the struggle he had to distribute his first film, Brother’s Keeper, in 1992.

“I wanted to dissect the Ponzi and how it worked, and what all those red flags were and why it’s representative of such incompetence, or worse, on the part of a lot of institutions that should have known better…I wanted people to understand just how easy it is to manipulate and cheat the system in part as a cautionary tale.” – Joe Berlinger

What is Covered:

00:00 – Introducing this episode’s guest, Joe Berlinger

01:33 – How to pronounce Bernie Madoff’s name

01:44 – Joe gives a brief outline of his docu-series, Bernie Madoff: The Monster of Wall Street

04:32 – How Bernie Madoff used other people’s greed to fund his Ponzi scheme

07:29 – How Bernie Madoff’s Ponzi scheme eventually collapsed

11:47 – A warning about Wall Street: It is not your friend

14:17 – Why Joe wanted to make Bernie Madoff: The Monster of Wall Street

17:49 – What makes Bernie Madoff’s Ponzi scheme different from others

18:55 – The irony that Madoff didn’t need to commit fraud in order to obtain more money

19:41 – On Bernie Madoff’s life defining decision: to be a liar rather than a failure

25:23 – How Joe’s lifelong interest in the stock market helped him make Bernie Madoff: The Monster of Wall Street

29:37 – Joe discusses whether or not he pays attention to other filmmakers and Brother’s Keeper, his first film

Educational

Bernie Madoff was a former American stockbroker and investment advisor who operated the largest Ponzi scheme in history. Here are some key points about him:

Ponzi scheme: Madoff’s scheme involved using new investors’ money to pay off existing investors, creating the illusion of high returns. In reality, there were no profits, and the scheme was destined to fail.

Size of scheme: Madoff’s scheme is estimated to have involved around $65 billion in fake investments, making it the largest Ponzi scheme ever discovered.

Arrest and conviction: Madoff was arrested in December 2008 and pleaded guilty to 11 counts of fraud, money laundering, and perjury in March 2009. He was sentenced to 150 years in prison and ordered to forfeit $17.5 billion in assets.

Victims: Madoff’s scheme had thousands of victims, including individuals, charities, and institutional investors. Many lost their life savings or suffered significant financial losses.

Impact: Madoff’s scheme had a significant impact on the financial industry and led to increased scrutiny of investment practices. It also highlighted the need for better regulation and oversight of financial markets.

Bernie Madoff: Mastermind of the Largest Fraud in U.S. History | FD Crime

Back to menu IMPORTANT CONTENT

9 apr 2023

Bernie Madoff: Mastermind of the Largest Fraud in U.S. History | FD Crime

Tales of the Grim Sleeper:

December 12, 2008, Bernard Madoff is apprehended by the FBI for what happens to be the biggest fraud in the history of finance. This white-collar criminal embezzled 65 billions of dollars and is bound to spend the rest of his life in jail. His gigantic swindle spanned over 20 years, and tens of people were involved, mostly without knowing it – for instance his wife and two sons.

This documentary tries to decrypt Madoff’s merciless and manipulative mind. Exclusive interviews with his close relations and experts from Harvard and New York University, shed light on this enigmatic character that turned Wall Street upside down. From the big picture to the unknown crucial details, get ready to get inside the mind of the most famous financial swindler of all times.

Bernie Madoff: How to BURN 65.000.000.000 Dollars | The Great Pretender | FD Finance

Back to menu IMPORTANT CONTENT

16 feb 2024

Bernie Madoff: Mastermind of the Largest Fraud in U.S. History | FD Finance

Watch ‘How Money Became Worthless ?’ here: • END OF THE ROAD: How Money Became Wor…

December 12, 2008, Bernard Madoff is apprehended by the FBI for what happens to be the biggest fraud in the history of finance. This white-collar criminal embezzled 65 billions of dollars and is bound to spend the rest of his life in jail. His gigantic swindle spanned over 20 years, and tens of people were involved, mostly without knowing it – for instance his wife and two sons.

This documentary tries to decrypt Madoff’s merciless and manipulative mind. Exclusive interviews with his close relations and experts from Harvard and New York University, shed light on this enigmatic character that turned Wall Street upside down. From the big picture to the unknown crucial details, get ready to get inside the mind of the most famous financial swindler of all times.

Educational

1 Prof. Rick Antle: Where Did Madoff’s Money Go?

2 Bernie Madoff: The Greatest Con in History

25 jun. 2019

Source/Further reading:

Andrew Kitrzman: Betrayal: The Life and Lies of Bernie Madoff

Diana B. Henriques: The Wizard of Lies

Colleen P. Eren: Bernie Madoff and the Crisis

Educarional

3 ‘Madoff’ Stars Richard Dreyfuss, Blythe Danner on Preparing for Roles

4 Conversations with Richard Dreyfuss of MADOFF

20 jun. 2016

Q&A with Richard Dreyfuss of MADOFF. Moderated by Scott Mantz, Access Hollywood.

Get a look into the mind of the man who pulled off one of the greatest cons in history in the primetime miniseries “Madoff,” airing on the ABC Television Network. Academy Award-winning actor Richard Dreyfuss stars as Bernie Madoff, with Emmy and Tony Award-winning actress Blythe Danner as his wife, Ruth. “Madoff” follows the prodigious rise and abrupt demise of the former investment advisor and the subsequent fallout with his family, associates and investors.

Madoff’s Ponzi scheme is considered to be the largest financial scam in United States history, but the impact was global. Losing billions of dollars for clients worldwide, including philanthropic foundations, celebrities, and retirement portfolios, the story of the fall of three-time NASDAQ Chair Bernie Madoff dominated headlinesin 2008-2009. The miniseries explores the complicated family dynamics within the Madoff clan and exposes the motivations and mechanics behind the monumental fraud.

“Madoff” also stars Tom Lipinski as Mark Madoff, Danny Defarrari as Andrew Madoff, Peter Scolari as Peter Madoff, Erin Cummings as Eleanor Squillari, Michael Rispoli as Frank DiPascali, Frank Whaley as Harry Markopolos. The miniseries also features Charles Grodin and Lewis Black.

“Madoff” is inspired by ABC News Chief Investigative Correspondent Brian Ross’ reporting from his book “The Madoff Chronicles” and additional reporting on the topic. “Madoff” is produced by Lincoln Square Productions in association with ABC Entertainment. Linda Berman and Joe Pichirallo executive produce. “Madoff” is directed by Raymond De Felitta and written by Ben Robbins.

5 Bernie Madoff Case Analysis | Mental Health & Personality | What is a Ponzi Scheme?

Back to menu IMPORTANT CONTENT

2 mei 2020

This video answers the questions: Can I analyze the Bernie Madoff case? What are the mental health and personality factors at work in this case? What is a Ponzi Scheme? Support Dr. Grande on Patreon: https://www.patreon.com/drgrande

Bernie made off was an investment advisor and market maker who operated the largest Ponzi scheme in history, the fraud took place over the course 20 to 40 years and cost investors between 10 and 20 billion dollars.

American Psychiatric Association. (2013). Diagnostic and statistical manual of mental disorders (5th ed.). Arlington, VA: Author.

Henriques, D. B. (2018). A Case Study of a Con Man: Bernie Madoff and the Timeless Lessons of History’s Biggest Ponzi Scheme. Social Research, 85(4), 745–766.

6 The Bernie Madoff Personality by Diana Henriques

Back to menu IMPORTANT CONTENT

30 mrt. 2012

7 The Early Show – Ruth Madoff: Bernie should hear this interview

31 okt. 2011

8 Bernie Madoff leaves behind checkered past in Palm Beach

15 apr. 2021

9 Millionaire Forced to Clean Houses After Falling Victim to Bernie Madoff

11 dec. 2018

10 2011: The Madoff family speaks to 60 Minutes

4 nov. 2021

11 Bernie Madoff, architect of the nation’s biggest investment fraud, dies at 82

14 apr. 2021

Bernard Madoff, architect of the biggest investment fraud in U.S. history, ripping off tens of thousands of clients of as much as $65 billion, has died, The Associated Press reported Wednesday. He was 82. For access to live and exclusive video from CNBC subscribe to CNBC PRO: https://cnb.cx/2NGeIvi

Bernard Madoff, mastermind of the biggest investment fraud in U.S. history, ripping off tens of thousands of clients of as much as $65 billion, died Wednesday. He was 82.

His death at the Federal Medical Center in Butner, North Carolina, was confirmed by the federal Bureau of Prisons.

Madoff died apparently from natural causes, the AP reported earlier, citing an unidentified person familiar with the matter. He would have turned 83 on April 29.

Madoff was serving a 150-year sentence at the prison, where he had been treated for what his attorney called terminal kidney disease. His request for compassionate release from prison was denied in June.

He pleaded guilty in 2009 to a scheme that investigators said started in the early 1970s and defrauded as many as 37,000 people in 136 countries over four decades by the time Madoff was busted on Dec. 11, 2008 — after his two sons turned him in. Victims included the famous — director Steven Spielberg, actor Kevin Bacon, former New York Mets owner Fred Wilpon, Hall of Fame pitcher Sandy Koufax and Nobel Peace Prize winner Elie Weisel — and ordinary investors, like Burt Ross, who lost $5 million in the scheme.

Madoff insisted the fraud did not begin until the early 1990s, when, he said, “the market stalled due to the onset of the recession and the Gulf War.”

In a 2013 email to CNBC from prison, Madoff claimed the break in the market that started the Great Recession led to his scam.

“I thought this would be only a short-term trade which could be made up once the market became receptive,” he wrote. “The rest is my tragic history of never being able to recover.”

In fact, investigators said, Madoff did not execute a single trade for his advisory clients for years. Rather than employing a so-called split-strike conversion strategy as he claimed, he simply deposited investors’ funds in a Chase bank account, paying off new customers with funds from earlier customers — a classic pyramid scheme — and providing his clients with falsified account statement. The investment “returns” shown on those statements — some $50 billion in all — were pure fiction.

The scandal at Bernard L. Madoff Investment Securities shattered investor confidence, which was already damaged by the financial crisis. And it led to sweeping changes at the Securities and Exchange Commission, which missed the fraud for years despite repeated warnings, including from independent investigator Harry Markopolos, who set out to analyze Madoff’s improbable returns and pronounced them fraudulent as early as 2000.

A subsequent investigation by the agency’s inspector general, H. David Kotz, found that rather than following up on clear evidence of fraud, SEC enforcement staffers decided to take Madoff’s word that his operation was legitimate.

“When Madoff provided evasive or contradictory answers to important questions in testimony, they simply accepted as plausible his explanations,” Kotz wrote.

In early 2020, Madoff asked a judge to release him from prison, saying he was in the end stages of kidney disease and was too old for a transplant.

“You know there hasn’t been a day in prison that I haven’t felt the guilt for the pain I caused on the victims and for my family,” he told The Washington Post at the time. He said his goal was to explain his actions to his grandchildren.

“You know I lost both my sons, and my wife is not really well. So it’s horrible,” he told the Post. “I was very close with my family. I made a terrible mistake. And you know I suffer with it. I’ll suffer with it when I get out.”

12 Diana Henriques Interview

4 aug. 2009

13 Diana Henriques – Lessons of the Bernie Madoff Scandal

19 mrt. 2012

14 Madoff’s NYC Penthouse

15 Bernie Madoff: the biggest Ponzi scheme in Wall Street history

In première gegaan op 3 nov. 2020

By 2007, the most massive financial fraud of modern history had been going on for decades. Billions of dollars had been flowing to a unique firm in Wall Street, where investors of all classes and worldwide trusted their money.

That elite fund was ultimately managed by one of the world’s most notorious conmen: Bernard L. Madoff, a businessman from Queens, New York. But then came the U.S. housing market crash and made the perfect storm in 2008. Only then, the massive fraud that Madoff had built couldn’t be sustained longer and crumbled.

A $64 billion disaster that left immeasurable tragedy for thousands of victims, orchestrated by a Wall Street sociopath who is serving a hundred and fifty years sentence in jail.

#startups #Slidebean #ponzi

0:00 – Intro

1:15 – Bernie Madoff: The Sociopath

2:39 – Bernie Madoff: The largest Ponzi fraud in history

5:23 – Bernie Madoff: A long road to justice

8:01 – Bernie Madoff: A Shakespearean tragedy

Read the video transcription + sources: https://slidebean.com/blog/startups-b…

16 JPMorgan settles for $2.6 billion fine over Madoff fallout

8 jan. 2014

17 The Pyramid Scheme that Collapsed a Nation

13 okt. 2018

19 Climb aboard Bernie Madoff’s yachts

1 dec. 2009

Betrayal : The Life and Lies of Bernie Madoff

Paperback English

By (author) Andrew Kirtzman

It was an inconceivable deception: over $65 billion stolen in the world’s largest Ponzi scheme. With new and revealing interviews with those who worked closest to him and his family, “Betrayal” is an in-depth, penetrating look at the man who perpetrated history’s most notorious financial crime. Despite the crush of media attention on Madoff’s scam, little is known about Madoff himself. What could lead a seemingly good man to ruin the lives of everyone who ever cared about him? What caused Bernie Madoff to commit an unspeakable act of betrayal, bankrupting his family, his friends, his mentors, and thousands of investors who depended upon him for their livelihoods?

“Betrayal: The Life and Lies of Bernie Madoff” is about the man who realised that he could have everything he wanted if he simply lied to the people who trusted him the most. Author Andrew Kirtzman tracked down more than a hundred people from Madoff’s past, poured over thousands of pages of court records; private e-mails; phone-conversation transcripts; and, census, military, and immigration records. The result is a fascinating story about the rise of a deeply immoral man.

21 Bernie Madoff Ponzi Scheme Victim Kills Himself By Leaping from Building

28 mrt. 2017

Emmy award-winning journalist Andrew Kirtzman, explores “The Life and Lies of Bernie Madoff” in Betrayal—an in-depth, personal look at the architect of the biggest financial fraud in history. The New York Times calls Betrayal, “a novelistic, you-are-there sort of narrative,” and the shocking story of the King of the Swindlers—and his hundreds of celebrity and corporation victims, and the everyday people who tragically invested their life savings with him—does indeed read like a page-turning thriller. But it’s all amazingly, disturbingly true

22 Bernie Madoff: American Greed’s Biggest Cons

Back to menu IMPORTANT CONTENT

3 aug. 2020

23 [VIDEO] PERSONAL TOUR INSIDE SWINDLER BERNIE MADOFF’S MANSION – PETER THORNE (9.1.09)

13 apr. 2011

We live in a society where a seventeen-year-old kid who robs a 7-Eleven of three hundred dollars goes to jail in a police van, while a thirty-four-year-old Wall Street banker who steals $1 billion from customers goes to Greenwich in his limousine.

A striking example of this state of injustice is the story of the illicit collaboration between Bernie Madoff and JPMorgan Chase. JPMadoff,written by the lawyers who represent 1,600 of the customers robbed by Bernie Madoff, offers a thoroughly documented account of the illegal conduct of the officers of JPMorgan Chase who watched, for years, as Madoff committed financial crimes. Why? Because they had the free use of Madoff’s billions of dollars of deposits. But this was not the only crime committed by officers of JPMorgan Chase. As the books lays out, JPMorgan Chase has become, like the Mafia, an institution that derives a substantial portion of its profits by violating the law.

Fans of Bernie Sanders, Liz Warren, Pam Martens and Matt Taibbi will appreciate this factual exposition of the long-standing corruption and criminal activity deep inside the institution of JPMorgan Chase and the utter failure of the Obama administration to prosecute criminal bankers.

24 1779 FBF: Helen Davis Chaitman – Bernie Madoff, JP Morgan Chase, and Other Immoral Financial…

17 dec 2021 The Creating Wealth Show

Today’s Flash Back Friday is from episode 671, first published on May 9, 2016.

Helen Davis Chaitman is a leading attorney on mortgage lending liability and a legal representative to over 1600 investors who were impacted by Bernie Madoff and his backers, JP Morgan Chase. She is the author of JP Madoff: The Unholy Alliance Between America’s Biggest Bank and America’s Biggest Crook. She reveals the unscrupulous, ugly underbelly of a financial institution that conducts business with more than 50% of American households and offers a solution which involves elected officials.

25 apr. 2016

25 Bernie Madoff and the largest known Ponzi scheme in history | 60 Minutes Full Episodes

31 aug 2024 Full Episodes | 60 Minutes

From 2009, Steve Kroft’s report on Bernie Madoff’s investment scheme and the whistleblower who figured it out. Also from 2009, Morley Safer’s interviews with Irving Picard and David Sheehan, who led a team trying to recover the billions of dollars in assets Bernie Madoff bilked from his investors. And from 2011, Safer’s interview with Bernie Madoff’s wife, Ruth Madoff, and son Andrew.

25 The Madoff family speaks to 60 Minutes

nov 2021

In October 2011, 60 Minutes interviewed Bernard Madoff’s wife Ruth and son Andrew in their first television interview following his arrest.

“60 Minutes” is the most successful television broadcast in history. Offering hard-hitting investigative reports, interviews, feature segments and profiles of people in the news, the broadcast began in 1968 and is still a hit, over 50 seasons later, regularly making Nielsen’s Top 10.

1 nov. 2011

26 Bernie Madoff Whistleblower Flags Next Big Financial Scandals (w/ Raoul Pal and Harry Markopolos)

24 okt. 2020

Educational.

27 Episode 1: Sins of A Father | Bernie Madoff Scandal | Full Episode

17 feb. 2021

28 Episode 2: The Numbers Always Rise | Bernie Madoff Scandal | Full Episode

18 mrt. 2022

29 Episode 3: Collapse | Bernie Madoff Scandal | Full Episode

19 mrt. 2022

30 Episode 4: Never Trust A Con Artist | Bernie Madoff Scandal | Full Episode

31 Ruth Madoff’s Tragic Life – How is she getting by today?

15 nov 2022

Fiction might sometimes lead us to believe that the uncommon can only happen on TV, but truth be told, the most unbelievable events actually take place all the time in real life. The former describes the drama of the rise and downfall of the Madoffs, famous for their billionaire fraudulent activities, which ultimately led them to a sad end.

We’ll try to answer to questions below in this video:

Who is Ruth Madoff?

Where is Ruth Madoff today?

What happened to Ruth Madoff?

How old is Ruth Madoff?

How tall is Ruth Madoff?

How rich is Ruth Madoff?

Where does Ruth Madoff live?

Who is Ruth Madoff husband today?

What is Ruth Madoff ethnicity and nationality?

We do not take any ownership of the music displayed in this video. Ownership belongs to the respected owner(s). Used under fair use policy. Music used for entertainment purposes displayed in this video.

33 How Bernie Madoff Fooled Everyone w/Malcolm Gladwell | Joe Rogan

34 Bernie Madoff: How he pulled it off

35 Bernie Madoff – His Life And Crimes (CNBC Documentaries – Part 1)

Back to menu IMPORTANT CONTENT

14 apr 2021

At the height of the Great Recession, Bernie Madoff confessed to running the biggest Ponzi scheme in history – a $65 billion fraud that left thousands of victims financially shattered. Madoff’s crimes went undetected for years, raising doubts about the government’s ability to protect investors. Andrew Ross Sorkin looks back at how Madoff made it to the pinnacle of the financial world, the unraveling of his scheme, and the fallout for his victims, Wall Street institutions and his family.

36 Bernie Madoff: His Life And Crimes (CNBC Documentaries – Part 2) | CNBC Prime

Back to menu IMPORTANT CONTENT

37 Bernie’s Big Bluff – How the Largest Ponzi Scheme Went Undetected for DECADES

Back to menu IMPORTANT CONTENT

38 MADOFF The Man Who Stole $65 Billion

39 MADOFF: The Man Who Stole $65 Billion

40 Madoff Whistleblower Harry Markopolos Part1

41 Madoff Whistleblower Harry Markopolos Part 2

42 on Today Show – Harry Markopolos

Back to menu IMPORTANT CONTENT

8 feb 2017

It took five minutes for Harry Markopolos to figure out that Bernard Madoff was a fraud. But it took him nearly ten years to get the SEC – and the world – to accept the difficult truth…that the man regarded as the foremost investor of our time was actually behind the largest case of investor fraud in history. Thanks to Harry’s persistent flag waving and years of covert communications with the SEC, the veil covering Madoff’s “financial magic” was eventually lifted, revealing an intricate $65 Billion Ponzi scheme built on equal parts deception and SEC ineptitude, and making Harry Markopolos a true hero for the ages. A story you must hear to believe, Harry and his amazing journey have been featured on 60 Minutes, in The Wall Street Journal and in the documentary Chasing Madoff.

43 How To Lie Your Way to $65 Billion: Bernie Madoff’s Fraud

7 feb 2023

You may have seen cases of financial fraud… but certainly not of this size. Let’s see how Bernie Madoff managed to fool everyone for more than 40 years stealing almost $65 Billion.

_______

All materials in these videos are used for educational purposes and fall within the guidelines of fair use. No copyright infringement is intended. If you are or represent the copyright owner of materials used in this video and have a problem with the use of said material, please get in touch with me via my email on the “about” page on my channel.

44 – 2009: Liquidating Bernie Madoff’s remaining assets

14 apr 2021

In 2009, 60 Minutes reported on the effort to recover billions of dollars Bernie Madoff bilked from his clients.

“60 Minutes” is the most successful television broadcast in history. Offering hard-hitting investigative reports, interviews, feature segments and profiles of people in the news, the broadcast began in 1968 and is still a hit, over 50 seasons later, regularly making Nielsen’s Top 10.

45 Bernie Madoff’s untold story: Author or ‘Madoff Talks’ outlines how he didn’t act alone

27 apr 2021

Yahoo Finance’s Adam Shapiro spoke to Jim Campbell, “Madoff Talks: Uncovering the Untold Story Behind the Most Notorious Ponzi Scheme in History” author, joined Yahoo Finance Live to discuss his new book and his inside look at Bernie Madoff.

46 The Bernie Madoff Scandal – A Simple Overview

14 mrt 2018

Bernie Madoff is infamous for his Ponzi scheme that’s been unraveled for nearly 10 years now. This video provides a simple overview of the scandal. What was happening, how he did it, the aftermath and consequences, along with a 2018 update.

Educational

47 – 10 things you still don’t know about the Bernie Madoff ponzi scheme the connection to FTX and crypto

Back to menu IMPORTANT CONTENT

22 jan 2021

Bernard “Bernie” L. Madoff was a market maker, wall street icon and convicted fraudster. He ran a Ponzi Scheme amounting to $64.8 Billion when all was said an done. Today we answer a key question surrounding Bernie that has plagued the SEC for years.

Why was he never caught?

48 Top 10 Craziest Ponzi Schemes

Back to menu IMPORTANT CONTENT

24 jun 2020

The Craziest Ponzi Schemes in History. Top Ten True Crime Stories. A hundred years ago in 1920, Charles Ponzi became famous when his investment scheme collapsed. Ponzi promised to double investors money in three months, at his peak he brought in more than $2 million per week at his offices in downtown Boston.

Ninety years later, Bernie Madoff was all over the news for the same reason. Madoff had taken Ponzis scheme and ran it on a much larger scale. Prosecutors estimated the fraud to be worth $65 billion. While Ponzis scheme burned out in less than six months, Madoffs scheme lasted for twenty years.

Dozens of Ponzi schemes are uncovered every year. The true toll of these Ponzi Schemes on the economy is unknown, but whenever you are being pitched something that seems too good to be true, odds are that it is.

I have put together this collection of the top ten strangest Ponzi schemes, and there are some really crazy schemes out there. Let me know if I have missed out on a good one.

0:00 Introduction

2:07 The Yilishen Tianxi Group – Ants

4:37 Susi Emu Farms

6:43 Cassandra Partners

10:05 Buddy Persaud – Astrology

11:24 JCS Enterprises – Virtual Concierge Machine

12:48 Sundown Entertainment – Comic Books

14:15 ZeekRewards

16:00 Mutual Benefits Corporation – Life Insurance

17:42 Greater Ministries International

18:27 Moneytron

Follow up video: https://youtu.be/0v_bq1ih7pI

Number 10

The Yilishen Tianxi Group

More than a million people invested in the Yilishen Tianxi Group by buying and raising boxes of black mountain ants.

Wang Zhendong the companys founder was sentenced to death for this fraud.

Number 9

Susi Emu Farms

M.S. Guru operated Susi Emu Farms, which promised investors a weekly return of $120 in exchange for a $3,000 investment that supposedly purchased a baby emu.

Number 8

Dana Giacchetto and Cassandra Partners

Dana Giacchetto managed money for A-list stars as Leonardo DiCaprio, Cameron Diaz, Matt Damon, Ben Affleck, and the cast members of the TV show Friends. He often partied with a cockatoo perched on his shoulder. It turned out he was a pirate.

Number 7

Buddy Persaud, was arrested and charged with operating a Ponzi scheme that promised risk-free returns derived from investing in the futures markets and other markets. His trading strategies were based on lunar cycles and the gravitational pull between Earth and the moon.

Number 6

JCS Enterprises

Investors were told that an investment in JCS Enterprises involved the purchase of a virtual concierge machine that resembled a bank automatic teller machine and allowed users to view advertisements for products or services. Investors were told that their machine would be placed in a business where it could generate lucrative profits.

Number 5

Sundown Entertainment Inc

Sundown Entertainment Inc purported to specialize in the distribution of film and comic-book rights. Potential investors were told that their investment would be used to purchase the rights to old film footage that then would be used to produce and distribute movies and documentaries. Sundown lured investors by promising returns on short-term investments of up to 150%. In total, Sundown raised more than $7 million from over 150 investors.

Number 4

ZeekRewards, solicited investors worldwide to participate in its penny-auction business where participants could “bid” on popular merchandise in 1-cent increments. In addition to the ‘retail” business, the company also promised its “affiliates” hefty returns for recruiting new participants and placing free advertisements on other sites. In return, those “affiliates” were rewarded with daily returns of 1.5%. In total, nearly 1 million “affiliates” would entrust more than $500 million to ZeekRewards.

Number 3

Mutual Benefits Corporation was a Florida based investment sales company that operated a huge ponzi scheme selling viatical settlements, with investors losing an estimated $835 million. The company operated for around ten years, selling $1.25 billion worth of life insurance policies to 30,000 investors.

Number 2

Greater Ministries International was a Christian ministry that ran a Ponzi scheme taking nearly 500 million dollars from 18,000 people. Headed by Gerald Payne in Tampa, Florida.

Number 1

Moneytron

Jean-Pierre Van Rossem, was a self-styled financial wizard and Marxist turned anarchist, one-time owner of a Formula One racing team, convicted fraudster, former heroin addict, novelist – and possibly the most colourful figure in the history of Belgian politics.

Van Rossem set up in business as a stock-market guru claiming he found a formula for predicting and beating markets, yielding enormous returns. He set up an investment company called Moneytron, the name of a “supercomputer” able to predict economic fluctuations, a machine nobody else ever got to see as it was supposedly kept behind a locked door in his office.

49 Mother Leaves Her Kid Behind

3 sep. 2018

2 jaar geleden