10 dec. 2009

http://mslaw.edu

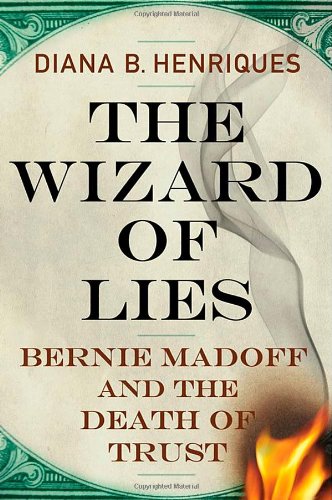

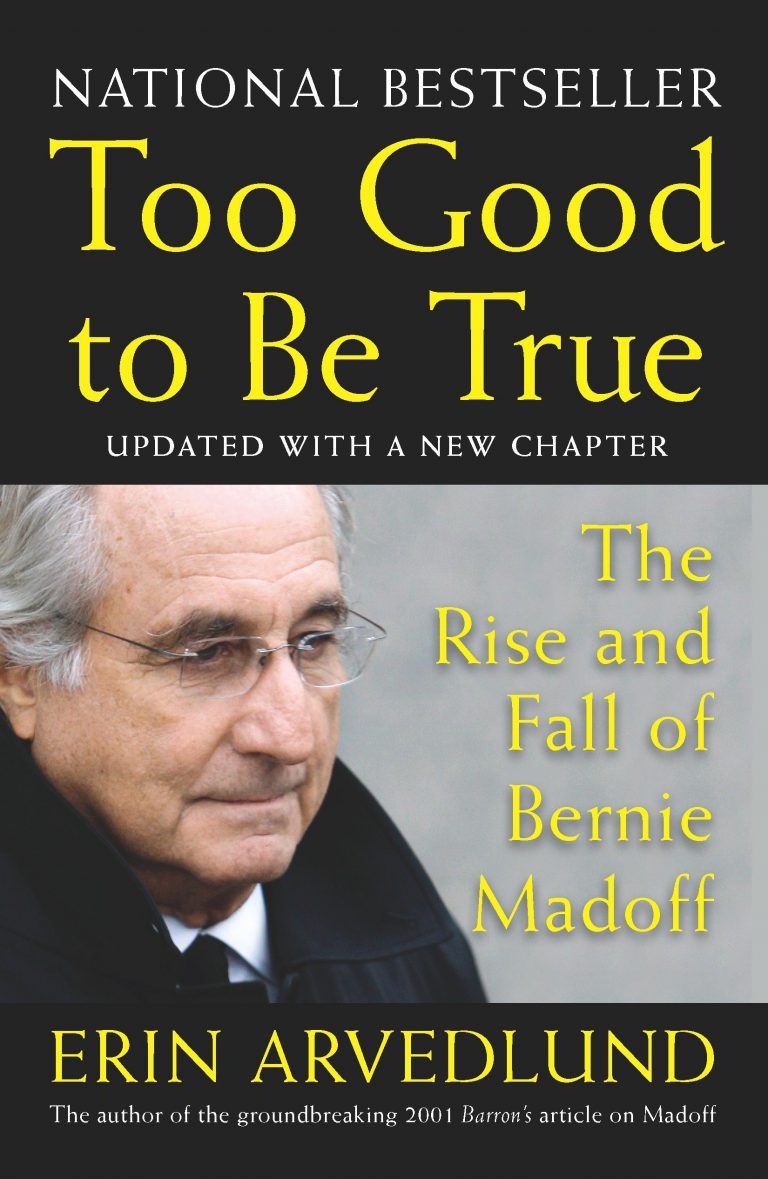

What were the Madoff family secrets? How did Madoff perpetrate the Ponzi scheme of our time? Erin Arvedlund tells the story of Madoff’s infamous billion dollar Ponzi scheme with the knowledge and detail of an insider, and sheds new light on the greatest financial enigma of American History.

In this episode of The Massachusetts School of Law’s Books of our Time, Dean Velvel, himself a Madoff victim, and Arvedlund discuss the history of the brokerage industry, the possible culpability of the entire Madoff family and Madoff family secrets, the difference between Madoff’s legitimate brokerage firm and his illegitimate hedge fund and the steps that lead up to the largest Ponzi scheme in American History. Arvedlund tells the story of Madoff’s infamous billion dollar Ponzi scheme with the knowledge and detail of an insider, and sheds new light on the greatest financial enigma of American History.

Erin Arvedlund first wrote about Bernie Madoff for Barrons in 2001 and published her book, Too Good to be True- The Rise and Fall of Bernie Madoff in August of 2009.

The Massachusetts School of Law also presents information on important current affairs to the general public in television and radio broadcasts, an intellectual journal, conferences, author appearances, blogs and books.

THE MASSACHUSETTS SCHOOL OF LAW IS NEW ENGLAND’S MOST AFFORDABLE AND DIVERSE LAW SCHOOL. We are dedicated to growing tomorrow’s leaders; empowering them with professional skills taught by instructors with real world experience, in a fun supportive campus environment.

Alex Goslar

2 jaar geleden