Bernard Madoff (Bernie Madoff)

Entrepreneur

Bernard Lawrence Madoff was an American entrepreneur and investor who served a 150-year sentence for fraud.

Madoff headed Bernard L. Madoff Investment Securities which he founded in 1960.

This company was one of the largest market maker firms on the NASDAQ.

On Dec. 11, 2008, Bernard L. Madoff confessed that his investment business was all “one big lie,” a Ponzi scheme that cost investors $65 billion.

Bernie Madoff was a former American financier and investment advisor who was involved in one of the largest financial frauds in history, commonly known as the Madoff Ponzi scheme. Here are some key points about him:

Bernie Madoff was born on April 29, 1938, in Queens, New York City, and grew up in a Jewish family.

He founded the investment firm Bernard L. Madoff Investment Securities LLC in 1960, which became one of the largest market-maker businesses on Wall Street.

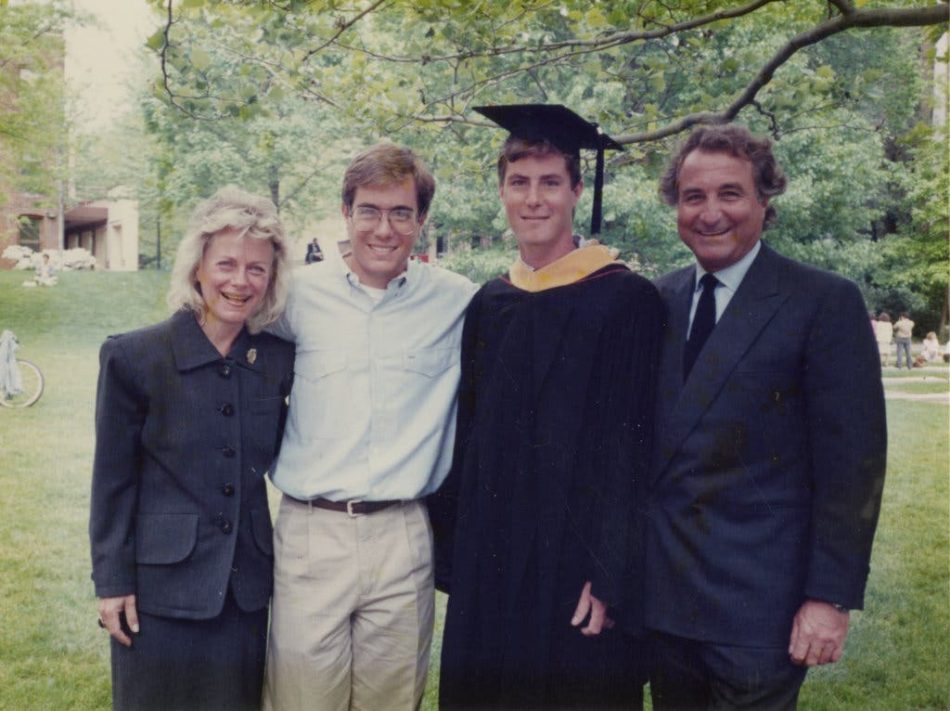

In 2008, Madoff admitted to his sons that his investment firm was actually a massive Ponzi scheme that defrauded thousands of investors out of billions of dollars.

The scheme involved using new investors’ money to pay off returns to earlier investors, while Madoff and his family took millions of dollars in profits.

Madoff was arrested in December 2008 and pleaded guilty to 11 felony charges in March 2009. He was sentenced to 150 years in prison, one of the harshest punishments ever handed down for financial crimes.

The scandal led to widespread outrage and criticism of Wall Street and financial regulators for failing to detect and prevent the fraud.

Madoff’s victims included individual investors, charities, and institutions, such as universities and hedge funds. The estimated loss from the Ponzi scheme was around $65 billion.

Madoff died in prison on April 14, 2021, at the age of 82.

2 The Superpower of the Conman | Alexis Conran | TEDxBerlin

25 jul. 2019

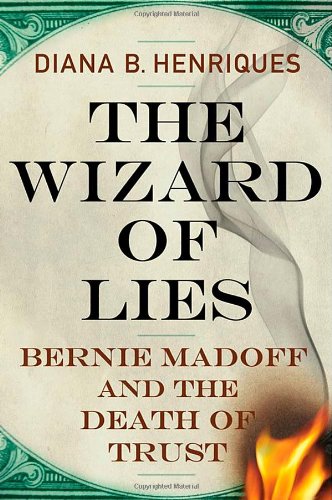

1 Lessons from history’s biggest Ponzi scheme | Diana Henriques | TEDxYale

20 mrt. 2018

3 Conman or Confidence-man? | Patrick Lyons | TEDxUTAustin

23 mei 2019

4 Bernie Madoff, infamous Ponzi schemer, dies

Back to menu IMPORTANT CONTENT

14 apr. 2021

5 ‘Wizard of Lies’ Author Details Madoff’s Fall Into Massive Financial Fraud

13 mei 2011

6 Part 1: The Hunt for Madoff’s Money

7 Part 2: The Hunt for Madoff?s Money

8 The Madoff Affair (full documentary) | FRONTLINE

Back to menu IMPORTANT CONTENT

16 apr. 2021

9 Diana Henriques: What Bernie Madoff Can Teach Us About Business Ethics

Back to menu IMPORTANT CONTENT

18 apr. 2012

10 The Madoff Hustle – Part 1

13 dec. 2010

11 The Madoff Hustle – Part 2

13 dec. 2010

12 The Madoff Hustle – Part 3

13 dec. 2010

13 The Madoff Hustle – Part 4

13 dec. 2010

14 Madoff Son Kills Self Two Years After Dad’s Arrest

13 dec. 2010

15 Ruth Madoff: Bernie should hear this interview

31 okt. 2011

16 Madoff’s Little Black Book

The Madoff Affair (full documentary) | FRONTLINE

Back to menu IMPORTENT CONTENT Listening recommended Must

16 apr 2021

On Dec. 11, 2008, Bernard L. Madoff confessed that his investment business was all “one big lie,” a Ponzi scheme that cost investors $65 billion. In this 2009 documentary, FRONTLINE explored how Madoff became the new poster child for Wall Street gall, greed and corruption.

Through exclusive television interviews with those closest to Madoff’s operation, veteran FRONTLINE correspondent Martin Smith and producer Marcela Gaviria unearthed the details of the world’s first global Ponzi scheme — a deception that lasted longer, reached wider and cut deeper than any other business scandal in history — in The Madoff Affair.

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting. Major funding for FRONTLINE is provided by the Ford Foundation. Additional funding is provided by the Abrams Foundation; the John D. and Catherine T. MacArthur Foundation; Park Foundation; and the FRONTLINE Journalism Fund with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen.

17 Inside Story – The Madoff Scandal – Dec 17 – Part 1

18 dec. 2008

18 Inside Story – The Madoff Scandal – Dec 17 – Part 2

18 dec. 2008

19 Inside the Madoff Scandal: Chapter One

27 dec. 2011

20 Inside the Madoff Scandal: Chapter Two

27 dec. 2011

21 Bernie Madoff 10 Years Later: Ep. 1 | Madoff Behind Bars

Back to menu IMPORTANT CONTENT

10 dec. 2018

22 Bernie Madoff 10 Years Later: Ep. 2 | The Next Madoff

13 dec. 2018

23 Bernie Madoff 10 Years Later: Ep. 3 | Hunting Bernie’s Billions

17 dec. 2018

25 The red flags in the Bernard Madoff Ponzi Scheme

20 jun. 2017

26 Exposing Madoff’s ponzi scheme

Back to menu IMPORTANT CONTENT

23 aug. 2011

27 Prof. Rick Antle: Where Did Madoff’s Money Go?

Back to menu IMPORTANT CONTENT

28 okt. 2015

28 How do Bernie Madoff’s fraud victims cope five years later?

12 dec. 2013

29 The Man Who Knew

1 mrt. 2009

30 It’s a Steal: A Madoff Home Goes Up for Sale | The New York Times

28 mei 2013

31 Bernie Madoff’s ‘scam of the century’: Ten years later

10 dec. 2018

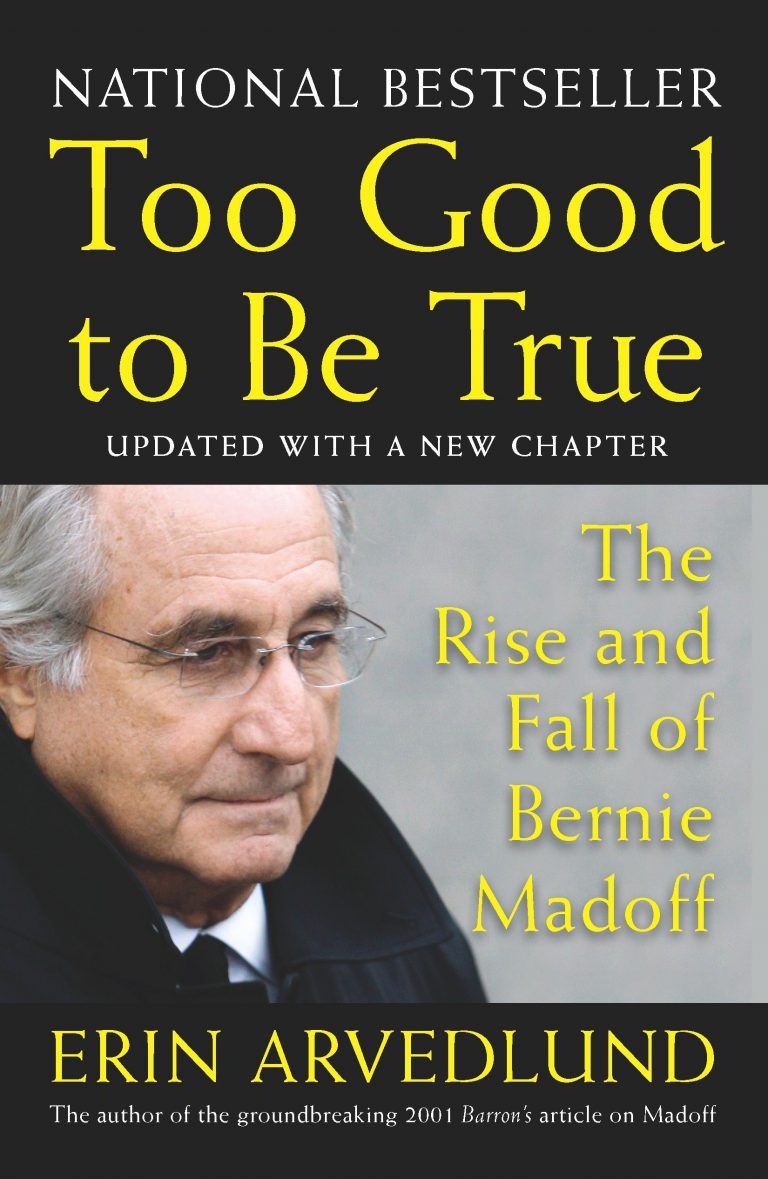

32 Too Good to be True- The Rise and Fall of Bernie Madoff And His Ponzi Scheme, Part 1

Back to menu IMPORTANT CONTENT

10 dec. 2009

http://mslaw.edu

What were the Madoff family secrets? How did Madoff perpetrate the Ponzi scheme of our time? Erin Arvedlund tells the story of Madoff’s infamous billion dollar Ponzi scheme with the knowledge and detail of an insider, and sheds new light on the greatest financial enigma of American History.

In this episode of The Massachusetts School of Law’s Books of our Time, Dean Velvel, himself a Madoff victim, and Arvedlund discuss the history of the brokerage industry, the possible culpability of the entire Madoff family and Madoff family secrets, the difference between Madoff’s legitimate brokerage firm and his illegitimate hedge fund and the steps that lead up to the largest Ponzi scheme in American History. Arvedlund tells the story of Madoff’s infamous billion dollar Ponzi scheme with the knowledge and detail of an insider, and sheds new light on the greatest financial enigma of American History.

Erin Arvedlund first wrote about Bernie Madoff for Barrons in 2001 and published her book, Too Good to be True- The Rise and Fall of Bernie Madoff in August of 2009.

The Massachusetts School of Law also presents information on important current affairs to the general public in television and radio broadcasts, an intellectual journal, conferences, author appearances, blogs and books.

THE MASSACHUSETTS SCHOOL OF LAW IS NEW ENGLAND’S MOST AFFORDABLE AND DIVERSE LAW SCHOOL. We are dedicated to growing tomorrow’s leaders; empowering them with professional skills taught by instructors with real world experience, in a fun supportive campus environment.

33 Too Good to be True- The Rise and Fall of Bernie Madoff and his Ponzi Scheme – part 2

Back to menu IMPORTANT CONTENT

11 dec. 2009

http://www.mslaw.edu

The strange death of Jeffrey Picower, why JP Morgan Chase pulled their funds from Madoff and stories of the SEC and SIPC.

In this second hour of Dean Velvel’s interview with Author Erin Arvedlund about her book, Too Good to be True, The Rise and Fall of Bernie Madoff, Arvedlund and Velvel discuss the details of how a mutual fund works, the derivation of madoff invented “payment for order flow” – now a standard Wall Street Practice – the unusual story of Madoff investor, Jeffrey Picower who died under mysterious circumstances, the implications of the Madoff fraud for all American investors, why JP Morgan Chase withdrew their money from Madoff shortly before Madoff’s confession and how the repeal of Glass-Steagall set the stages for the Madoff fraud.

The Massachusetts School of Law also presents information on important current affairs to the general public in television and radio broadcasts, an intellectual journal, conferences, author appearances, blogs and books.

THE MASSACHUSETTS SCHOOL OF LAW IS NEW ENGLAND’S MOST AFFORDABLE AND DIVERSE LAW SCHOOL. We are dedicated to growing tomorrow’s leaders; empowering them with professional skills taught by instructors with real world experience, in a fun supportive campus environment.

34 DP/30: Chasing Madoff, subject Harry Markopolos (pt 1of 2)

1 aug. 2011

️

️

35 DP/30: Chasing Madoff, subject Harry Markopolos (pt 2 of 2)

2 aug. 2011

36 Markopolos: I gift wrapped and delivered the largest Ponzi scheme in history to the SEC

4 feb. 2009

37 Man behind the world’s biggest financial scam dies serving 150 year prison sentence

15 apr. 2021

Fraudster Bernie Madoff – who was sentenced to 150 years behind bars in 2009 over Wall Street’s largest fraud – has died in prison aged 82.

In 2009 Madoff pleaded guilty to what is likely the largest financial scam in history which he carried out by using new investor’s money to pay back old investors.

Madoff’s victims ranged from celebrities such as Kevin Bacon, Kyra Sedgwick, and talk show host Larry King, to international banks, companies, charities and thousands of individual investors.

His lies began to unravel in 2008 when the financial crisis triggered investors to make withdrawals from his fund and he was unable to find new investors to pay off the old ones.

A quarter of the stolen money from the estimated $83 billion Ponzi scheme has not been returned to investors.

38 Disgraced investor Bernie Madoff dies in prison at age 82

15 apr. 2021

39 There were no winners in the Bernie Madoff case… investors should seek transparancy: Attorney

Back to menu IMPORTANT CONTENT

15 apr. 2021

40 Bernie Madoff Prison Interview With Barbara Walters

Back to menu IMPORTANT CONTENT

41 Bernie Madoff – His Life And Crimes (CNBC Documentaries – Part 1)

14 apr 2021

Watch the full documentary on CNBC tonight at 8p ET or on CNBC.com with your cable provider: https://cnb.cx/3tlnPVB. Watch part two on @ CNBC Prime:

• Bernie Madoff: His Life And Crimes (C…

At the height of the Great Recession, Bernie Madoff confessed to running the biggest Ponzi scheme in history – a $65 billion fraud that left thousands of victims financially shattered. Madoff’s crimes went undetected for years, raising doubts about the government’s ability to protect investors. Andrew Ross Sorkin looks back at how Madoff made it to the pinnacle of the financial world, the unraveling of his scheme, and the fallout for his victims, Wall Street institutions and his family.

42 Bernie Madoff: His Life And Crimes (CNBC Documentaries – Part 2) | CNBC Prime

14 apr 2021

At the height of the Great Recession, Bernie Madoff confessed to running the biggest Ponzi scheme in history – a $65 billion fraud that left thousands of victims financially shattered. Madoff’s crimes went undetected for years, raising doubts about the government’s ability to protect investors. Andrew Ross Sorkin looks back at how Madoff made it to the pinnacle of the financial world, the unraveling of his scheme, and the fallout for his victims, Wall Street institutions, and his family. Watch the full documentary TONIGHT at 8P ET on CNBC!

43 Impossible Ladder Prank Just For Laughs Gags

23 aug 2013

Alex Goslar

2 jaar geleden